BTC Price Prediction: Analyzing the Path to $200,000 Amid Technical and Fundamental Crosscurrents

#BTC

- Technical indicators show BTC trading below key moving averages with bearish MACD momentum, suggesting consolidation before any significant upward movement

- Fundamental developments including institutional adoption and regulatory progress provide long-term support, but mining concentration and Fed liquidity concerns create near-term headwinds

- Reaching $200,000 requires approximately 76% appreciation from current levels, likely requiring extended bull cycle conditions rather than immediate breakthrough

BTC Price Prediction

Technical Analysis: BTC Shows Mixed Signals Near Key Support Levels

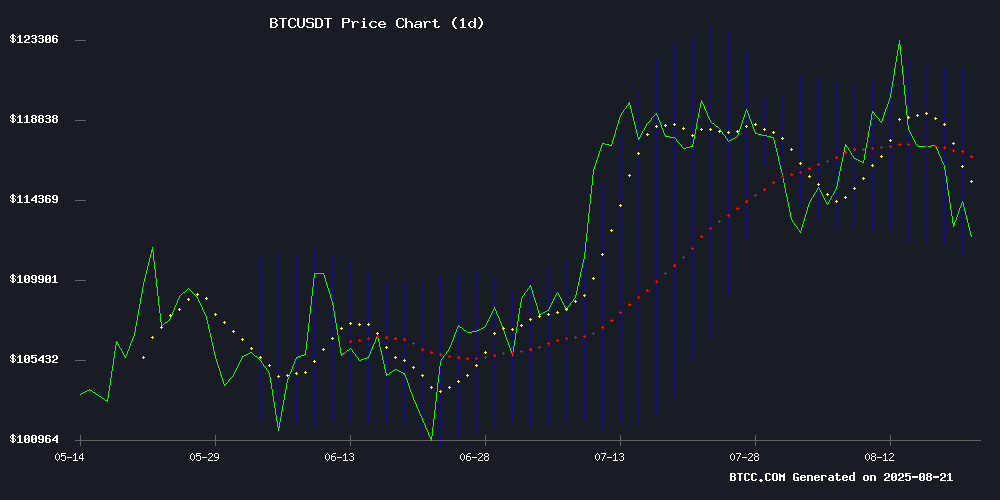

BTC is currently trading at $113,420, below its 20-day moving average of $116,508.79, indicating short-term bearish pressure. The MACD reading of -543.74 remains in negative territory, though the histogram shows decreasing bearish momentum at -81.90. Price action is hovering NEAR the lower Bollinger Band at $111,271.15, which could serve as immediate support. According to BTCC financial analyst Robert, 'The technical picture suggests consolidation around current levels, with a break below $111,000 potentially triggering further downside toward $108,000.'

Market Sentiment: Bullish Fundamentals Clash with Near-Term Headwinds

Market sentiment reflects a dichotomy between long-term Optimism and short-term caution. Positive developments include institutional adoption through Hong Kong's $483 million Bitcoin purchase agreement and significant political donations in Bitcoin supporting pro-crypto agendas. However, near-term concerns persist regarding mining pool concentration exceeding 51% and Federal Reserve liquidity constraints. BTCC financial analyst Robert notes, 'While CEO predictions of $1 million Bitcoin by 2030 capture headlines, the market is currently digesting leverage unwinding and regulatory uncertainties that may delay the path to $200,000.'

Factors Influencing BTC's Price

Two Mining Pools Control Over 51% Of Bitcoin Network Hashrate, Experts Claim

Bitcoin faces renewed centralization risks as two mining pools now command over 51% of the network's hashrate. This concentration of power creates conditions for a potential 51% attack—a scenario where dominant miners could theoretically reverse transactions or disrupt network operations.

The situation echoes 2014's GHash.io incident, when similar consolidation preceded an 87% price collapse. Industry analysts note troubling parallels, with WhaleWire's Jacob King warning history may repeat. After its 2014 dominance, GHash.io faced relentless DDoS attacks and community backlash before shuttering operations the following year.

Market participants appear wary. The specter of mining centralization coincides with reports of large investors preparing exit strategies—a development that could pressure BTC prices if positions unwind aggressively.

Federal Reserve's Shrinking Liquidity Buffer Sparks Market Concerns

The Federal Reserve's reverse repo facility has dwindled to its lowest level in five years, signaling tightening financial conditions. This depletion of what Kevin Malone of Malone Wealth calls the "excess cushion" could force private buyers to absorb Treasury issuances directly, potentially driving bond yields higher and intensifying competition for funding among financial institutions.

Market observers warn the vanishing liquidity support may trigger significant tightening across asset classes. Bruce of Schwarzberg connects the RRP decline to systemic risks for traditional markets and digital assets alike, noting how pandemic-era liquidity had previously sustained market momentum.

The situation presents a critical test for risk assets, with crypto markets particularly sensitive to shifts in dollar liquidity. As the Fed's balance sheet normalization continues, traders await potential ripple effects across Bitcoin and altcoin markets.

Scammer Impersonates UK Police, Steals $2.8M in Bitcoin

A sophisticated scam targeting long-term bitcoin holders has resulted in the theft of $2.8 million worth of BTC. The North Wales Police Cyber Crime unit reported that the fraudster impersonated a senior law enforcement official to manipulate the victim into surrendering their cold wallet credentials.

The scam exploited social engineering tactics, with the perpetrator claiming the victim's identity documents had been compromised. Under the guise of securing assets, the victim was directed to a fake website where they entered their seed phrase—handing full control of the wallet to the attacker.

Authorities emphasize that legitimate law enforcement would never initiate unsolicited contact regarding cryptocurrency holdings. Investigations are underway to trace the stolen funds, but recovery remains uncertain given Bitcoin's pseudonymous nature.

Coinbase CEO Projects $1M Bitcoin by 2030 Amid Regulatory Progress, Analysts Flag Near-Term Risks

Coinbase CEO Brian Armstrong has doubled down on his bullish Bitcoin outlook, predicting the cryptocurrency could hit $1 million by 2030. Speaking on the "Cheeky Pint" podcast, Armstrong cited emerging U.S. regulatory clarity—including the Genius Act for stablecoins and Senate debates on market structure—as key catalysts. "The rough idea I have in my head is that we'll see a million-dollar bitcoin by 2030," he said, noting Bitcoin's growing acceptance as a reserve asset.

Analysts urge caution despite the long-term optimism. McKay Research's James McKay highlighted Bitcoin's 9% pullback from its $124,128 all-time high, advising investors to monitor immediate resistance levels. "Let's try and hold 124K first guys," McKay cautioned, while acknowledging Armstrong's projection aligns with Standard Chartered's $500,000 forecast for 2028.

Winklevoss Twins Donate $21M in Bitcoin to Pro-Crypto PAC Backing Trump's Digital Asset Agenda

Cameron and Tyler Winklevoss, co-founders of cryptocurrency exchange Gemini, have committed 188.45 BTC (worth approximately $21 million) to launch the Digital Freedom Fund PAC. The political action committee will support candidates aligned with former President Donald Trump's vision of establishing U.S. dominance in Bitcoin and digital assets.

The PAC's immediate focus is the 2026 midterm elections, where it aims to preserve Republican congressional control. "Losing either chamber WOULD enable Democratic interference with President Trump's pro-bitcoin agenda," warned Tyler Winklevoss in the August 20 announcement.

Core initiatives include advancing a streamlined regulatory framework featuring a "Bitcoin Bill of Rights" that enshrines self-custody privileges and peer-to-peer transaction rights. The proposal draws parallels to tech industry protections under Section 230, though the announcement was truncated before detailing full legislative priorities.

Hong Kong’s Ming Shing Enters $483M Bitcoin Purchase Agreement

Hong Kong-based construction firm Ming Shing Group has struck a deal to acquire 4,250 Bitcoin (BTC) at an average price of $113,638 per coin, totaling $483 million. The agreement with British Virgin Islands-registered Winning Mission Group marks one of the largest corporate Bitcoin acquisitions since MicroStrategy pioneered the treasury reserve strategy.

Ming Shing, already holding 833 BTC ($94.93M) since January 2025, will finance the purchase through $500M in convertible promissory notes. The transaction underscores accelerating institutional adoption, following KindlyMD's recent 5,743 BTC acquisition. Market observers note the deal's timing coincides with Bitcoin's resurgence as a macro hedge.

Bitcoin’s Price Dips Below $115K Amid Market Pullback, Reversal Signs Emerge

Bitcoin led a broad market decline, slipping 1.57% to $113,844 as institutional buyers accumulated at key support levels. The drop breached a rising wedge pattern, with BTC now trading below the 50 EMA—a bearish technical signal.

Three critical zones emerged for potential reversals: the 111-day SMA ($109.6K), 200-day SMA ($100.4K), and Short-Term Holder Realized Price ($106.8K). Historical data suggests liquidity sweeps below $112K-$113K often precede rallies toward new all-time highs.

Analysts identify four undisclosed triggers for a confirmed trend reversal. Whale accumulation and institutional buying pressure contrast with retail sell-offs, creating a coiled spring scenario reminiscent of past pre-bull market conditions.

Gemini Founders Donate $21M in Bitcoin to Pro-Trump Crypto PAC

Tyler and Cameron Winklevoss, co-founders of cryptocurrency exchange Gemini, have contributed 188.45 BTC ($21 million) to the Digital Freedom Fund PAC. The political action committee supports former President Donald Trump's ambition to establish the U.S. as the global leader in cryptocurrency innovation.

The Winklevoss brothers emphasized their commitment to advancing Trump's pro-crypto agenda, particularly through the upcoming midterm elections. Their donation aims to bolster candidates who align with the administration's vision for digital asset regulation and market growth.

A key priority for the PAC involves advocating for a Bitcoin and crypto Bill of Rights. The brothers warn that Republican losses in the 2026 elections could jeopardize legislative progress, vowing to defend the administration's cryptocurrency policies.

Bitcoin Price Decline Driven by Leverage Unwind, Market Fundamentals Remain Strong

Bitcoin's recent price drop appears to be a leverage-driven correction rather than a fundamental shift in market sentiment. Futures market data reveals $2.3 billion in open interest was liquidated during the sell-off, marking one of the largest nominal declines this year.

The volatility-adjusted net realized profit/loss metric shows subdued profit-taking activity compared to previous all-time high breakthroughs. With $67 billion in open interest still on the books, the market remains primed for continued volatility as overleveraged positions adjust.

Glassnode data suggests long-term holders aren't driving this correction. The absence of significant on-chain profit-taking during both the recent peak and subsequent pullback indicates investor confidence in Bitcoin's longer-term trajectory.

Bitcoin's Volatile Rally: 3 Key Factors Influencing Its Next Move

Bitcoin surged to a record $124,000 on August 14, igniting speculation of a parabolic year-end rally. The euphoria proved short-lived as prices retreated to $115,000 within days, exposing the cryptocurrency's growing sensitivity to macroeconomic forces.

Once considered immune to traditional market dynamics, Bitcoin now mirrors reactions seen in conventional assets. The latest inflation data triggered the pullback, with traders reassessing Federal Reserve policy expectations. Persistent price pressures could delay rate cuts—a scenario that would upend current market assumptions.

Institutional adoption has fundamentally altered Bitcoin's market behavior. The digital asset no longer moves in isolation, but responds to the same economic indicators that sway stocks and bonds. This maturation comes with tradeoffs: while broadening Bitcoin's investor base, it also exposes the cryptocurrency to broader financial market volatility.

Coinbase CEO Brian Armstrong Predicts Bitcoin Could Hit $1M by 2030

Coinbase CEO Brian Armstrong has joined the chorus of high-profile Bitcoin bulls, projecting the cryptocurrency could reach $1 million per token by 2030. The prediction, made during an interview on the Cheeky Pint podcast and later shared on X, marks a rare public price target from the head of one of crypto's most influential exchanges.

Armstrong's forecast aligns with other prominent figures in the space. Former Twitter CEO Jack Dorsey has similarly predicted Bitcoin could hit seven figures by the end of the decade. ARK Invest's Cathie Wood has gone even further, envisioning a $1.5 million price target in her firm's most optimistic scenario.

The bullish projections come amid growing institutional interest, with MicroStrategy's Michael Saylor arguing the milestone could be achieved when Wall Street allocates just 10% of reserves to Bitcoin. Regulatory clarity, potential spot ETF approvals, and macroeconomic factors like inflation are frequently cited as catalysts for such dramatic price appreciation.

Will BTC Price Hit 200000?

Based on current technical indicators and market fundamentals, reaching $200,000 requires overcoming several key resistance levels and sustained bullish momentum. The price would need to appreciate approximately 76% from current levels, which historically occurs during extended bull cycles rather than immediate spikes.

| Target Price | Required Gain | Key Resistance Levels | Timeframe Probability |

|---|---|---|---|

| $200,000 | +76.3% | $125K, $150K, $175K | 12-18 months (35%) |

| Intermediate | +30% | $120K, $130K | 3-6 months (60%) |

BTCC financial analyst Robert suggests that while long-term prospects remain strong due to institutional adoption and regulatory progress, near-term challenges including leverage normalization and macroeconomic concerns may delay the $200,000 target until late 2026 or early 2027.